- Market Anticipates Signals from the Fed on Interest Rates: The stock market is declining, bond prices are rising, and the dollar remains weak. These factors collectively indicate expectations for a 50 basis point rate cut by the Fed in September.

- Germany’s Economic Crisis Shows No Signs of Improvement: Recent data on trade balance and industrial production confirm the ongoing struggles in Germany’s economy. The ECB is also expected to cut rates in September.

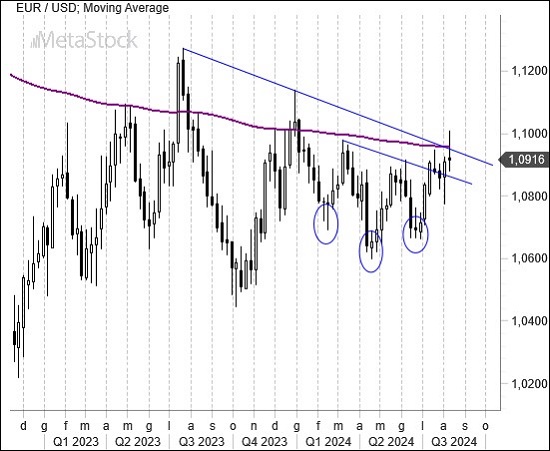

- EurUsd Hovering Near the 1.10 Resistance Level: If this level is breached, it could trigger a delicate technical scenario for the dollar.

Market Volatility Rises Amid Geopolitical Tensions and Fed Speculation

Markets remain highly volatile across both bond and equity sectors. Geopolitical tensions, combined with shifts in speculative carry trade positions and uncertainty surrounding upcoming U.S. macroeconomic data, are driving a cautious approach. The market appears to have moved too aggressively in predicting a 125 basis point rate cut by the Fed over the next 12 months. Based on the current economic data, this outlook seems overly optimistic, and only the next inflation report may provide additional clarity. According to the Atlanta Fed’s GDP Now model, the economy grew by 2.8% in the second quarter and 2.9% in the third quarter, while the New York Fed’s model predicts a 2.1% growth rate. There’s no sign of a recession on the horizon.

Meanwhile, the dollar is holding steady as a safe-haven currency, especially during periods of geopolitical tension in the Middle East. In Europe, Germany continues to report negative data, with the latest being a 4.1% drop in industrial production following an 8.9% decline in May. Exports are also faltering, with a monthly decrease of 3.4% against stagnant imports (+0.3%). The next ECB meeting is scheduled for September 12, and the market is anticipating a 25 basis point rate cut. If this doesn’t materialize, the euro could climb significantly higher than its current levels.

Technical Analysis: EurUsd Tests Key Resistance, Potential for Major Moves

The EurUsd is once again attempting to break through critical resistance levels that could open up new technical scenarios. The market’s ups and downs, coupled with high volatility, haven’t led to the expected flight to quality solely towards the U.S. dollar. The euro and yen have also benefited from outgoing flows, especially from those who have reaped the rewards of high-yield bonds and currencies through carry trade strategies in recent months. As mentioned last week, the 1.09/1.10 level represents, for obvious technical reasons, a line beyond which significant shifts could occur for the dollar. If the euro succeeds, a return to the 1.15 to 1.17 range is the most likely scenario, even with some volatility, considering that many option barriers and derivative contracts are positioned between 1.10 and 1.12. Such a development would align with a scenario where the Fed aggressively cuts interest rates to combat an economic recession.

The most challenging seasonal period for the U.S. dollar is nearing its end, and historically, from the financial crisis onward, August and the following three months have generally seen gains for the dollar, before the typically tough year-end period. The Dollar Index chart confirms a critical moment for the greenback. The double top formation has quickly met its targets, but now the key is to hold above the support linked to the uptrend line from the 2023 lows. Below 102, further weakness for the dollar could be expected.

Leave a Reply

You must be logged in to post a comment.