- U.S. inflation continues to decline, and as expected, the Federal Reserve is likely to cut interest rates this week. The reduction will likely be 25 basis points at the final FOMC meeting before the November election.

- The European Central Bank (ECB) cut rates as anticipated and has hinted at further measures without providing markets with a clear roadmap for future rate cuts.

- The EurUsd is still testing resistance around the 1.12 level but remains unable to break through. Following the ECB meeting, the pair settled just below 1.11.

Central Banks in Focus as Markets Brace for Rate Cuts

While the “Trump trade” appears to be deflating after the TV debate between the former president and Kamala Harris, the market is focusing on central banks, expecting significant rate cuts to prevent an economic slowdown. This slowdown is becoming apparent in a cooling labor market. Yields across the curve are falling in both the U.S. and Europe, where the ECB has already made the first move, cutting rates by 25 basis points as expected and promising further action by the end of the year if inflation continues to retreat. There is little reason to doubt this trajectory, given the falling prices of oil and industrial metals, with China playing a key role in driving not just internal but also global deflation. ECB President Christine Lagarde, in her usual post-announcement press conference, confirmed that the cost of money will remain at a restrictive level for as long as necessary. Lagarde is determined to bring inflation back to 2%, with forecasts still pointing to consumer prices at 2.5% in 2024 and 2.2% in 2025. In the U.S., after early September unemployment data, inflation was the key macro event of the week. In August, lower energy costs pushed consumer prices down to 2.5% from July’s 2.9%. The core inflation rate came in as expected at 3.2%, confirming its downward trend and giving the green light for the Federal Reserve to lower rates in this week’s meeting. The FOMC is expected to cut interest rates by 25 basis points, bringing them down from the 23-year high of 5.25%/5.50%.

Technical Analysis: EurUsd Faces Critical Resistance at 1.12 Amid Divergence with Gold

It’s undeniable that EurUsd is facing key levels that serve as a technical threshold for the medium and long term. These levels are the resistance points near 1.12, which have been tested several times in recent weeks. After an initial test at the end of August and another attempt in early September, the euro dropped back to the 1.095/1.10 support range. This level represents a crucial pivot for the technical future of the world’s most important currency pair. A move below this threshold would negate the bullish structure built over the past few months, leading to a much more cautious outlook for the rest of the year—especially as the U.S. dollar tends to perform seasonally well in the final months of the year.

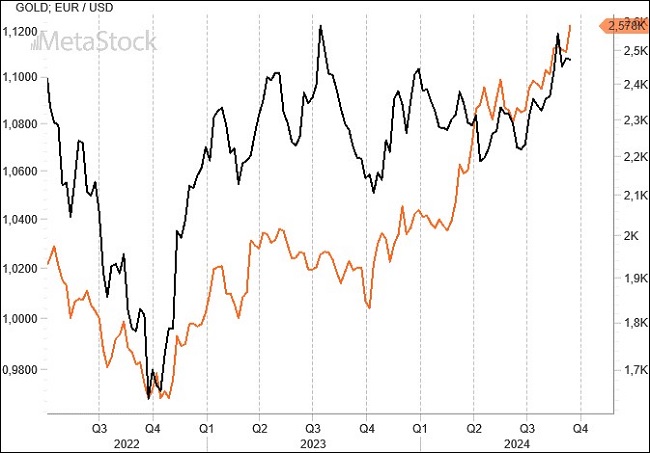

The following chart draws an interesting parallel between gold and the U.S. dollar, specifically EurUsd and gold. There is a strong positive correlation between the two: when gold rises, EurUsd follows suit due to the depreciation of the greenback, and vice versa. However, in recent sessions, as gold has surged to new highs, EurUsd has retreated, creating a divergence. It remains unclear which asset is giving the correct signal—whether gold has risen too much, or if the dollar has strengthened against the prevailing logic. We will soon find out.

Leave a Reply

You must be logged in to post a comment.