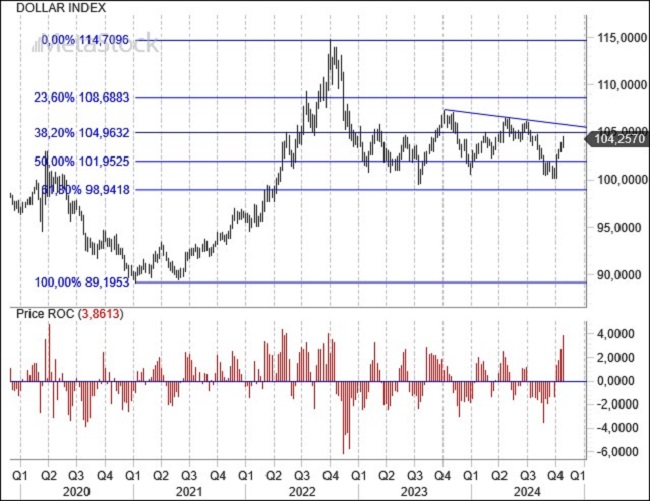

- The United States heads to the polls, but attention is also on the Federal Reserve’s decision regarding interest rates. The new President and monetary policy will be pivotal events in a week that has already provided a disappointing appetizer with lackluster employment data.

- Europe is witnessing an unexpected rise in inflation for October, alongside better-than-expected economic growth, which has bolstered the euro. Growth has exceeded forecasts.

- The EurUsd currency pair approaches a critical technical juncture, with 1.08 being a delicate and significant support threshold. For now, the euro has demonstrated a determination to maintain these levels.

Market Focus: U.S. Election and European Inflation

The impending U.S. presidential election will be the primary market mover over the coming days—not just in the currency markets, but also in equities, bonds, and cryptocurrencies, given the positions taken by candidates Trump and Harris during the campaign. The victory of either candidate will shape the political landscape for the next four years for a nation facing a backdrop of economic growth, easing inflation, full employment, and energy independence.

However, challenges await the next President, starting with a national debt that becomes increasingly burdensome to service amid rising interest rates.

Immediately following the election, attention will turn to the FOMC; on November 6-7, the Federal Reserve will make its decision on interest rates. This meeting is particularly anticipated after the last rate cut of 50 basis points in September. Since then, expectations for further reductions in borrowing costs have significantly diminished, with the market no longer anticipating a 200 basis point cut within the next twelve months. Chairman Powell will have to navigate the delicate balance between fueling economic growth and managing inflation, which struggles to fall below the target level due to the robust state of the economy and employment.

Consumer confidence recorded a notable surge in October, reaching a yearly high. The only sour note was the near-total absence of jobs created in October, attributed to hurricanes and various strikes. In recent weeks, Fed officials have signaled a reluctance to accelerate rate cuts until inflation provides concrete evidence of a retreat below the 2% target. The core PCE data published last Friday confirmed the difficulty in bringing down consumer prices.

Meanwhile, inflation is gaining momentum in Europe, with Germany leading the charge as consumer prices recorded a 2% increase in October. This is occurring within a context of sluggish yet better-than-expected economic recovery. The Eurozone’s GDP for the third quarter rose by 0.4%, surpassing the anticipated 0.2%. Germany is emerging from recession with a 0.2% growth rate, France at 0.4%, Italy remains flat, while Spain enjoyed a growth rate of 0.8%.

Technical Analysis: EurUsd Approaches Key Support Levels

EurUsd approaches the U.S. election near key support levels that will be crucial for its future trajectory. A downward breach of the 1.078/1.08 support levels would hold significant implications, particularly as it would coincide with a weekly oversold condition that has previously indicated a primary bottom in the past two instances.

In this context, the upward trend line that has been in place for a year connects its increasing lows, reinforcing the importance of this technical level on the eve of the elections.

The presence of key supports around 1.08 is also evident on daily charts. The 61.8% Fibonacci retracement of the entire rally from April to August 2024 has contained the ardor of the greenback, and now the euro must painstakingly rebuild its base for a rebound.

The monthly close above 1.08 provided an initial significant signal for EurUsd; however, the outcome of the election and the subsequent direction of the exchange rate will define a scenario that still favors a long EurUsd strategy. This is contingent, at least, on the durability of the aforementioned support levels.

Leave a Reply

You must be logged in to post a comment.