Author: Efrat Koren

-

EurUsd Weekly Outlook, April 22, 2024 – Diverging Monetary Paths and the Test at 1.05

The monetary policies of the Federal Reserve and the European Central Bank are heading in opposite directions. Jerome Powell has adopted a more hawkish stance than Christine Lagarde, pushing up U.S. interest rates and bolstering the dollar, which is further favored by an increasingly tense geopolitical climate. The widening gap between the growth and expected…

-

EurUsd Weekly Outlook for June 19, 2023 – Awaiting the Downturn of Interest Rates

Hawks Fly High in Washington and Frankfurt The market most likely had a sense of what was going to transpire with interest rates following the release of the U.S. inflation data last Tuesday. With an anticipated figure of 4.1% following April’s 4.9% (5.2% for the core data, down from the previous 5.5%), U.S. inflation played…

-

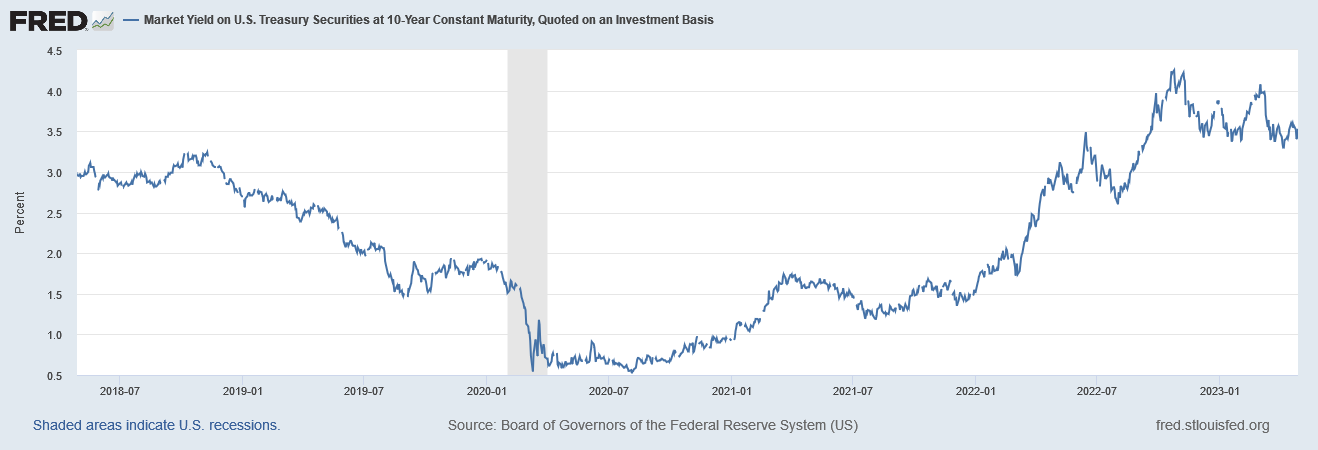

10-Year Treasury Yield Unveiled: Key Insights and Market Implications

The Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity is a key financial indicator, serving as a benchmark for long-term interest rates and offering valuable insights into the health of the economy and credit markets. This measure reflects the yield on a hypothetical U.S. Treasury security with a fixed maturity of 10 years,…

-

First Republic Bank Seized and Sold to JPMorgan Amid Banking Crisis – FDIC Takes Decisive Action

On Monday (today), regulators stepped in to take over First Republic Bank and proceeded to sell it to JPMorgan Chase, a decisive response to the ongoing two-month banking crisis that has unsettled the financial sector. First Republic, which experienced a significant impact on its assets due to surging interest rates, had been grappling to survive…

-

Anticipation Builds for Federal Reserve and ECB Interest Rate Decisions Amid Key Economic Indicators

Central banks worldwide are in the spotlight this week, as investors eagerly anticipate policy-setting meetings from the Federal Reserve and the European Central Bank (ECB). Market participants will also be closely watching the monthly U.S. jobs report and other key economic indicators for insights into the health of the global economy.The Federal Open Market Committee’s…

-

Why is Bitcoin Going Down Today?

Bitcoin, the world’s largest cryptocurrency, is facing a challenging market. With its current value around $23,500 per Bitcoin, a significant drop from its peak value of nearly $69,000 in November 2021, it remains uncertain if the digital asset will ever return to its former glory. Despite its potential for high returns, Bitcoin’s downward trajectory has…