Bitcoin, the world’s largest cryptocurrency, is facing a challenging market. With its current value around $23,500 per Bitcoin, a significant drop from its peak value of nearly $69,000 in November 2021, it remains uncertain if the digital asset will ever return to its former glory. Despite its potential for high returns, Bitcoin’s downward trajectory has left many investors worried about its future prospects.

The Bitcoin market saw a decline in 2022, with its value dropping to below $16,000. Yet, by January 2023, the cryptocurrency managed to bounce back and trade above $23,000. In the following analysis, we will explore the key drivers behind Bitcoin’s fall in value in the year 2022.

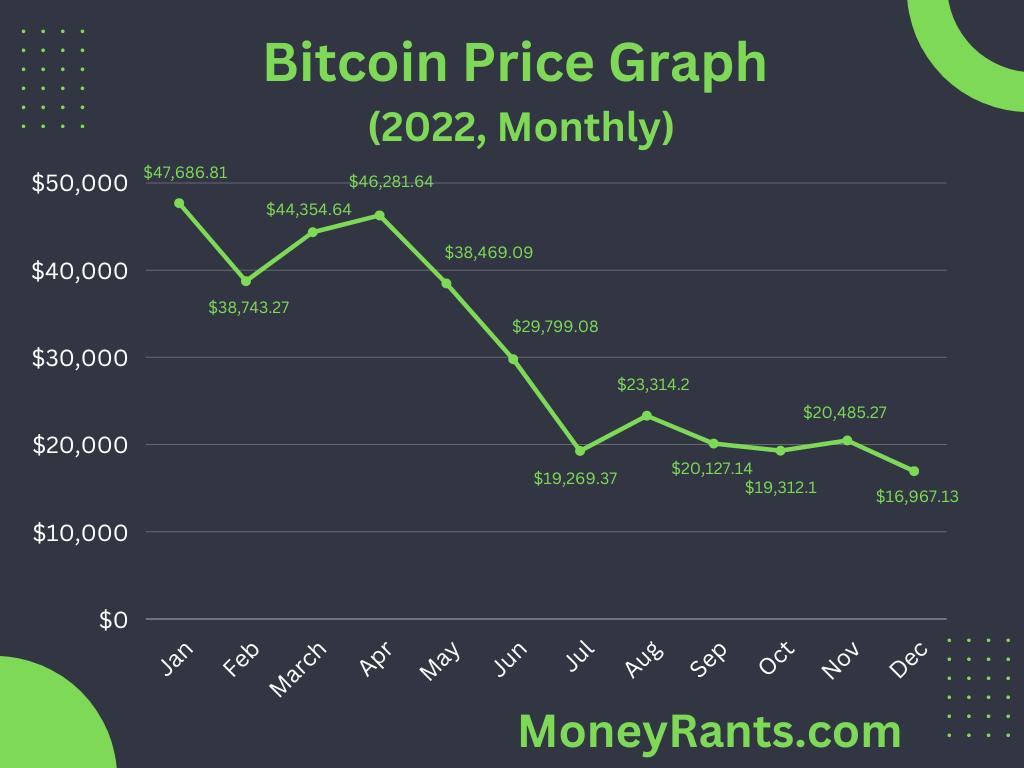

A Month-by-Month Review of Bitcoin’s Drop in Value in 2022

The year 2022 was marked by a general downward trend of bitcoin, reaching a low by the end of the year.

The cryptocurrency started off the year 2022 with a price of $47,686.81 in January. In February, it experienced a downward trend, with the price dropping to $38,743.27.

In March, the price of bitcoin showed an upward trend, rebounding from the drop in February, with the price reaching $44,354.64. This was followed by another increase in April, with the price reaching $46,281.64.

May saw a downward trend, with the price of bitcoin falling to $38,469.09. The trend continued into June, with the price dropping to $29,799.08, and into July, with the price reaching $19,269.37.

August saw a small rebound, with the price of bitcoin reaching $23,314.20. However, the downtrend continued in September, with the price dropping to $20,127.14, and in November, with a price of $20,485.27. The year ended on a low note, with the price reaching $16,967.13 in December.

Unpacking the Factors Behind Drops in Bitcoin Price – Why is Bitcoin Going Down

Security Breaches

A security breach at a major cryptocurrency exchange can cause a significant drop in the price of bitcoin. This is because security breaches can lead to the loss of large amounts of bitcoins, thereby affecting market confidence and causing panic selling. The investors, who fear their assets might be lost or stolen, sell their bitcoin holdings, which contributes to a drop in its price. This, in turn, can result in a vicious cycle of selling, further dropping the price.

Moreover, security breaches raise concerns about the safety and security of digital assets stored in exchanges, and this can reduce the trust in the overall cryptocurrency market. This can result in investors moving their assets to more secure storage solutions, such as hardware wallets, and away from exchanges. This shift in investor behavior can also have a negative impact on the demand for bitcoin and other cryptocurrencies, thereby putting downward pressure on their prices.

Negative Regulatory Announcements

Government authorities around the world are still figuring out how to regulate cryptocurrencies, and their announcements can create uncertainty and affect investor sentiment. Negative regulatory announcements, such as restrictions or bans on the use of cryptocurrencies, can cause the price of bitcoin to drop. For example, the Chinese government’s crackdown on cryptocurrencies caused a significant drop in the price of Bitcoin.

Market Liquidity Issues

Market liquidity refers to the ability of an asset to be easily bought or sold without affecting its price. In the case of Bitcoin, market liquidity can play a significant role in determining its price. When there is high market liquidity, large amounts of Bitcoin can be bought or sold without affecting the price too much. On the other hand, if market liquidity decreases, it becomes more difficult to buy or sell Bitcoin, which can result in price volatility.

There are various factors that can impact market liquidity in the cryptocurrency market, including changes in regulation, investor sentiment, or market manipulation. For example, if there is news of a crackdown on cryptocurrency trading in a particular country, it may cause investors to withdraw from the market, reducing market liquidity. Conversely, a positive regulatory announcement or a sudden surge in investor interest in Bitcoin can increase market liquidity and stabilize its price.

Adoption by Major Companies

The adoption of Bitcoin and other cryptocurrencies by major companies can have a significant impact on the price of Bitcoin. When a major company announces that it will accept Bitcoin as a form of payment or invest in the cryptocurrency, this can increase demand for Bitcoin and drive up the price. For example, in 2021, Tesla announced that it had invested $1.5 billion into Bitcoin and that it would accept Bitcoin as a form of payment for its products. This announcement caused the price of Bitcoin to jump over 16% in just a few hours.

However, the reverse is also true. When a major company announces that it will no longer accept Bitcoin or sell its holdings, this can decrease demand and drive down the price. For example, in May 2021, Tesla suspended purchasing vehicles with Bitcoin and stopped selling any of the Bitcoin on its balance sheet due to environmental concerns. This caused Bitcoin to drop 13%.

Technical Issues

Technical problems and network issues can also cause a drop in the price of Bitcoin. For example, the crash of the Mt. Gox exchange in February 2014 resulted in a significant drop in the price of the cryptocurrency.

Market Competition

The growth of other cryptocurrencies such as Ethereum and Ripple can lead to a decrease in the price of Bitcoin.

Political and Economic Instability

Political and economic uncertainty can also impact the price of Bitcoin. For example, the economic sanctions imposed on countries such as Iran and Venezuela caused the price of Bitcoin to surge as citizens sought to protect their savings from hyperinflation.

Chronicle of Bitcoin’s Crashing : Key Events that Triggered Major Price Declines

Binance’s Rescue Deal for FTX (June 2021)

On June 9, 2021, it was reported that Binance had signed a nonbinding agreement to buy FTX’s non-U.S. unit to help cover a “liquidity crunch” at the rival exchange. The proposed deal followed a week of speculation about FTX’s financial health and led to $6 billion in withdrawals in the 72 hours prior to the deal being announced. This raised questions about the solvency of one of the world’s largest crypto exchanges, causing a second day of sharp declines in the crypto market and pushing down the price of bitcoin.

China’s Crackdown on Cryptocurrency (May 2021)

On May 18, 2021, the Chinese government announced that it was cracking down on cryptocurrency exchanges and initial coin offerings, causing a major sell-off in the crypto market. The price of bitcoin dropped by nearly 20% in the days following the announcement.

Tesla’s Impact on Bitcoin’s Volatility: Drops in Price Amidst a Tug of War

Tesla and its CEO, Elon Musk, have made waves in the cryptocurrency world, causing the price of Bitcoin to fluctuate with their announcements and actions. While Musk’s support for Bitcoin in early 2021, including adding the #bitcoin hashtag to his Twitter profile and Tesla’s announcement to invest $1.5 billion into the cryptocurrency, caused a surge in bitcoin price, on May 12, 2021, Tesla suspended the use of Bitcoin as a form of payment due to environmental concerns, leading to a 13% drop in price. Elon Musk later attempted to address his sustainability concerns with North American Bitcoin miners and this resulted in a 12% surge in Bitcoin’s price once again. This highlights the influential power of Tesla and Elon Musk on the price of Bitcoin, causing it to fluctuate in both positive and negative directions. Their actions remain a crucial factor in the ongoing tug of war for the future of cryptocurrencies.

American Authorities announcements and Bitcoin Price Drops

American authorities have played a significant role in shaping the cryptocurrency market and have been the cause of several events that have led to drops in the price of Bitcoin.

In July 2021, The U.S. Securities and Exchange Commission (SEC) announces plans to increase regulatory scrutiny of initial coin offerings (ICOs), causing a drop of over 10% in the price of Bitcoin. In March 2022, The U.S. Securities and Exchange Commission (SEC) announces that it will crack down on illegal activities in the cryptocurrency market, causing a drop of over 10% in the price of Bitcoin. In June 2022, The U.S. Treasury announces plans to impose new taxes on cryptocurrencies, causing a drop of over 5% in the price of Bitcoin. In December 2022, The U.S. Commodity Futures Trading Commission (CFTC) announces increased regulatory scrutiny of the cryptocurrency market, causing a drop of over 10% in the price of Bitcoin.

COVID-19 – A Market Dive and Quick Recovery

The coronavirus pandemic has taken the world by storm, bringing significant changes to daily life and causing markets to plummet globally. The cryptocurrency market was not immune to these effects, with Bitcoin seeing a rapid decrease of over 50% in a week as the world moved towards lockdown measures. On March 12th, the price of Bitcoin experienced a major drop, falling from nearly $8,000 to below $5,000 in just one day, a decrease of 39%. This resulted in frozen market liquidity and investors flocking to cash. Despite the initial dip, Bitcoin traders quickly bounced back and by May, the price had returned to pre-pandemic levels, aided by the Federal Reserve’s massive stimulus plan and 0% interest rates.

Leave a Reply

You must be logged in to post a comment.