- The U.S. economy continues to grow at 5% despite interest rates being at their highest since the start of the century.

- Both the dollar and gold benefit from the ongoing geopolitical tensions in the Middle East and regarding Ukraine.

- The ECB keeps interest rates unchanged amid a general economic slowdown affecting the Eurozone, particularly Germany.

- PMI data suggests a recession is possible in the latter part of 2023.

- EurUsd, after a brief bounce, is pressing on key support levels around 1.04; falling below could lead to parity.

Europe Slows Down, ECB Holds Firm

As October draws to a close, the markets find themselves under heightened tension due to a series of factors generating uncertainty. Foremost among them are the geopolitical events, especially the Israel-Palestine conflict threatening to ignite the entire Middle East. In addition, deepening divisions between various political-economic factions are fueling diplomatic strains. Gold soars close to $2,000 an ounce, aptly illustrating the market’s rising apprehensions, including fears of a possible recession—even though the U.S. remains directly unaffected at this point.

The U.S. yield curve continues to flatten, and historically, higher yields on longer terms relative to shorter ones have often signaled an impending economic downturn. Yet, the American economy doesn’t seem to be on the brink of turning negative, at least according to the GDP and PMI figures, which remain above the 50 basis-point mark. Preliminary third-quarter GDP registered an impressive +5%, buoyed by consumer spending, real estate, and public expenditure. It remains to be seen if this surge can be maintained in the subsequent quarter.

Thanks to a growth differential still favoring the U.S., the dollar pushes its 2023 highs against both the euro and the Japanese yen. Europe tells a different story, where PMI indicators have slipped below 50 points for both manufacturing and services. According to the Bundesbank, Germany is likely heading into its third consecutive quarter of recession. While German consumer confidence deteriorates, the IFO index remains stable. Monetary supply M3 continues to shrink in the Eurozone due to tight monetary policies, with a -1.2% contraction in September following August’s -1.3%. The ECB has chosen to keep interest rates unchanged. ECB’s President, Lagarde, clarified that while the battle against inflation is far from over and will persist, lending is experiencing a significant slowdown, hampering economic recovery. After ten consecutive rate hikes, we might be witnessing the end of the ECB’s tight monetary policy, even though this could spell trouble for the euro.

EurUsd, Sustained Pressure

We had previously identified the 200-day moving average as the maximum rebound point for EurUsd during its pullback phase. Although this materialized, it faded rapidly without testing the dynamic resistance positioned in the 1.075/1.08 area. This target remains in sight should the correction regain momentum in the coming weeks. However, given current circumstances, it’s unlikely to be surpassed, as the dollar currently benefits from a slew of factors including risk aversion, geopolitical tensions, and favorable interest rate differentials.

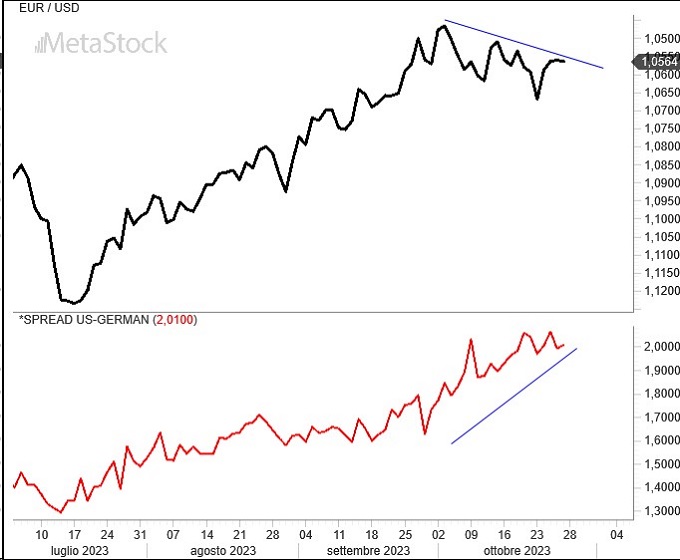

The disparity between EurUsd (inverted in the subsequent figure) and the 10-year Treasury-Bund spread didn’t align with the currency market’s perception that the euro was inexplicably appreciating, given the widening yield differential favoring U.S. government bonds. In due course, the exchange rate (illustrated here on an inverted scale) realigned itself, reinforcing what, for now, remains a crucial factor in halting the dollar’s strength.

Leave a Reply

You must be logged in to post a comment.