This week, the focus in the United States will be on unemployment data, following the Federal Reserve’s announcement of an imminent rate cut. The market is pricing in at least three cuts by the end of the year.

In Europe, few significant developments have occurred, with the market looking towards Frankfurt to understand the direction of monetary policy aimed at reviving the Eurozone’s economy after inflation data confirmed another slowdown.

The EurUsd tested the latest resistance levels, beyond which a significant upward acceleration was expected. However, the greenback has responded well, mitigating the risk of a debacle for now.

Market Bets on Aggressive Fed Rate Cuts as U.S. Economic Optimism Grows

The market is currently betting on a rate cut of between 75 and 100 basis points for the U.S. by the end of the year. The upcoming labor market data this week, followed by inflation figures, will clear any doubts regarding the intensity of a move that will start to take shape in September following Powell’s announcement at Jackson Hole.

In the meantime, consumer confidence has shown remarkable resilience, reaching over 103 points in August, up from 101.9 in July. Both the expectations and current conditions components of the index have improved, signaling the continued strength of U.S. economic growth. In fact, the second quarter GDP was revised upward to 3%, thanks to a boost in personal consumption, which jumped by 2.9%. The economic cycle is reaccelerating.

The intensity of the next move—whether 25 or 50 basis points—will be determined by the August payroll data, which we will see this week. A figure above 200,000 would leave little doubt about Powell’s decision to use monetary scissors cautiously.

Equity markets are grateful, as are bond markets, in what appears to be the perfect scenario to extend the grace period of the past few months. However, there is also increasing speculation about the upcoming Trump-Harris election showdown, which will reach its peak in less than 50 days when Americans will choose between Democratic continuity or a return to Trumpism. This event could generate some volatility in the markets, including currency markets, depending on the outcomes of the various polls that will multiply from now until November.

In contrast, few notable developments have come from Europe, which will soon need to reduce interest rates to make financial maneuvers more manageable for heavily indebted Eurozone countries like Italy and France. Inflation in the Eurozone, according to preliminary August data, slowed further to 2.2% from 2.6% in July, marking the lowest levels since July 2021, with core inflation still distant from the ECB’s target at 2.8%.

Technical Analysis: EurUsd Pullback Signals Bullish Entry Point

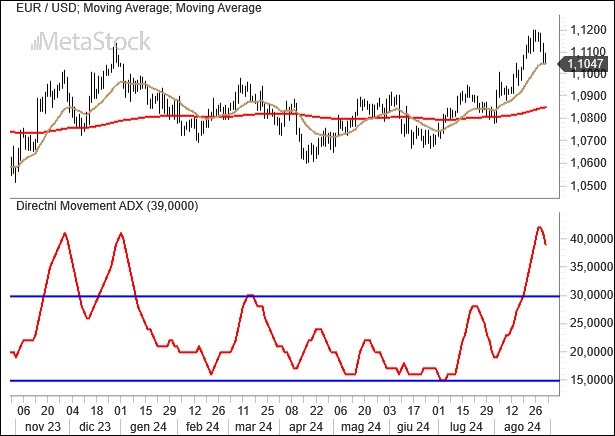

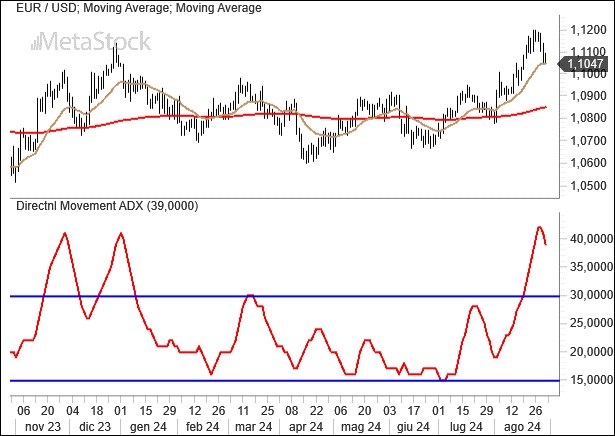

The technical trader has already identified the moment to go long on EurUsd. A pullback to the 20-day moving average at 1.105 (which has been reached) represents an ideal entry point, according to the ADX technique—the ultimate indicator of bullish trend strength—which recently hit 40 points. This indicates that bulls still dominate the EurUsd scene and that the ongoing pullback could be a good opportunity to attempt a renewed assault on the 1.12 resistance area.

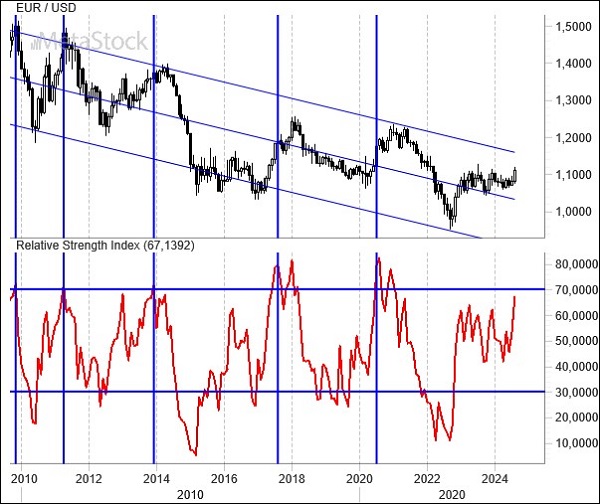

The monthly overbought condition on EurUsd has not yet appeared, but we are close to a threshold that, if reached, would trigger the countdown for the top of the exchange rate. The RSI in overbought territory, i.e., above the conventional 60-point mark, has rarely identified a primary peak in the past, but it has been an excellent predictor of a less directional phase that, within a few months, would formalize a lasting peak, continuing the bear market that has existed since the 2008 crisis.

Leave a Reply

You must be logged in to post a comment.