- The United States approaches November elections with a tight race between Trump and Harris, while the economy performs better than expected, curbing anticipated rate cuts.

- Europe contends with an apparent economic slowdown, compelling the ECB to sustain a dovish stance on rates, which in turn weakens the euro.

- Eur/Usd hovers near 1.08 support levels—a crucial technical juncture likely to persist until the election. Amid rising Middle Eastern tensions, the market shows a preference for safe assets like the dollar and gold.

Rate Differentials and Rising Tensions Drive Eur/Usd Decline Ahead of U.S. Election

Central banks hold the reins in the Eur/Usd exchange. The interest rate differential between the Eurozone and the U.S. remains a clear influence on currency movements. With the market adjusting to reduced expectations of aggressive Fed rate cuts and increased potential for ECB intervention, Eur/Usd has followed suit, tracking the now-negative EU-U.S. rate differential of over 160 basis points downward.

Interest rate expectations remain bearish for Eur/Usd. Markets are pricing in a 150 to 175 basis point rate cut in Europe, while anticipated cuts across the Atlantic are now trimmed to 125 basis points. With France offering higher yields than Spain and Portugal, the euro has understandably retreated to a significant support zone at 1.08, as projected.

Meanwhile, mounting tensions between Israel and Iran, along with divergent growth forecasts between Europe and the U.S., deepen this divergence. The International Monetary Fund has revised upward its U.S. GDP projections for 2024 and 2025 (to 2.8% and 2.2%, respectively) while lowering Eurozone forecasts (0.8% in 2024 and 1.2% in 2025).

Adding to the mix is the countdown to the American election in November. With Trump and Harris locked in a tight contest, the outcome will undoubtedly impact currency markets. The FOMC meeting scheduled for November 6-7, right after Election Day, will be especially notable.

Technical Analysis: Eur/Usd Tests Critical 1.08 Support

Eur/Usd has now recorded four consecutive weeks of declines, reaching the 1.08 support zone. Here, the ascending trend line from October 2023’s low converges. For the euro, a visible reaction at this level is essential to stave off further declines. Without it, a return to 1.05 and a formal breakdown of the euro’s bullish trend may become inevitable. The oversold conditions seen on a daily scale, last observed in April, could offer initial support for a euro rebound.

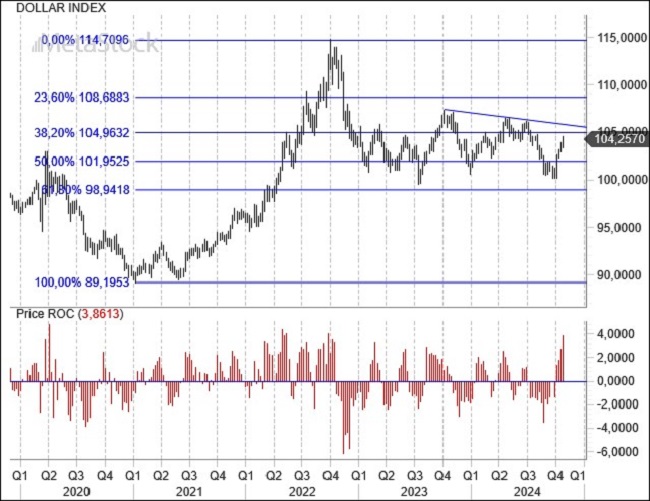

The outlook for Eur/Usd remains uncertain, and the same holds for the Dollar Index, which is nearing key resistance at 105. Despite overly dovish expectations in recent weeks, the dollar has bounced back, holding above 2023 lows with a strong, four-week rally since September’s bottom.

The test of the 105 level will soon clarify whether this phase signals a medium-term bearish shift or is part of a broader bull market that has persisted since the 2008 crisis. Meanwhile, the monthly rate of change reaches a significant 4%, suggesting an overbought condition for the dollar.

Leave a Reply

You must be logged in to post a comment.