- Powell acknowledges that the U.S. economy is performing better than expected, effectively signaling a pause in rate cuts during the first half of 2025. Better-than-expected employment data will not prevent one last rate cut in December.

- France is in turmoil following the collapse of the Barnier government, while Germany’s crisis deepens. The Eurozone faces a particularly challenging moment, with the ECB needing to implement significant rate cuts and a brutal war looming at its borders.

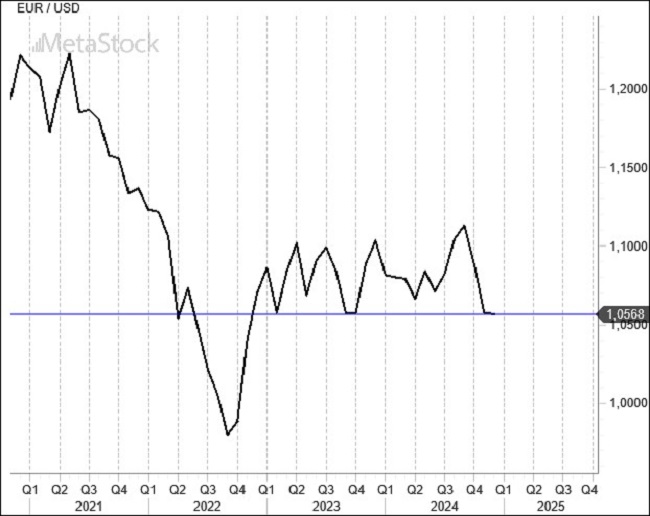

- EUR/USD confirms some bearish technical breakdowns, but for now, it stabilizes around 1.05. More is needed to target parity.

U.S.Economic Strength Boosts Dollar as European Crisis Intensifies

Powell’s comments, the last public remarks before the December 2024 FOMC meeting, sound like a precursor to what will happen to U.S. interest rates in 2025, at least in the first part of the year. The message is clear: the U.S. economy is outperforming expectations, and despite a restrictive monetary policy, it is likely that interest rates will no longer decrease, as Powell himself stated.

While in Washington, there may be questions about what went wrong with monetary policy management or whether a “new normal” for inflation is set at 3%, the answers remain unclear. However, the foreign exchange market has already absorbed this trend, particularly with the dollar strengthening against the euro.

The usual expected U.S. unemployment data confirmed a robust labor market, with new payrolls exceeding expectations. Meanwhile, in Europe, France’s political crisis takes center stage. The collapse of the Barnier government after just three months reignites the crisis in Europe’s second-largest economy. The most concerning aspect is that this crisis arises before the approval of the 2025 budget, forcing France to manage this critical phase of the year in an emergency state. Macron will now attempt to form a new government to avoid elections.

The spread between French OATs and German government bonds has reached 90 basis points, with the difference in yield between French and Italian bonds under 40 basis points. We do not foresee a new crisis in the Eurozone, but the uncertainty surrounding France and the bleak prospects for the country weigh heavily on the political and economic decisions of the entire continent. This, in turn, burdens the euro, which is already weakened by the profound economic crisis in Germany, a country set to hold elections in February.

The market expects the ECB to cut rates by 175 basis points over the next 12 months, and with the Fed likely to pause, this could lead to further weakening of the euro.

Technical Analysis: EUR/USD at a Crucial Juncture for 2025

The double top thesis for EUR/USD remains valid but has yet to be fully formalized. As seen on the chart, the double top at the 1.12 area requires a definitive break below 1.05 to target a move decisively below parity. The absence of a clear breakdown signal keeps the possibility of a prolonged trading range open. As we’ll see shortly, the closing of December will be pivotal.

EUR/USD has never closed below 1.055 for a month since the beginning of 2023. As shown in the chart, this level becomes crucial from a prospective standpoint. A break of this support, which we now understand is decisive for the future of the single currency, would end the current sideways movement and likely lead to bearish implications for EUR/USD, pushing it below parity in 2025 due to divergent monetary policies and economic growth. The December close will therefore be fundamental.

Leave a Reply

You must be logged in to post a comment.