- Trump heralds the beginning of a new golden age, with the market responding enthusiastically by buying tech stocks and betting on the continuation of the US economic growth. However, concerns about inflation will prevent the Federal Reserve from cutting interest rates.

- The European Union looks on with concern at Trump’s announcement of new tariffs, which would undermine the already fragile European growth. Lagarde has shown less dovishness regarding interest rates.

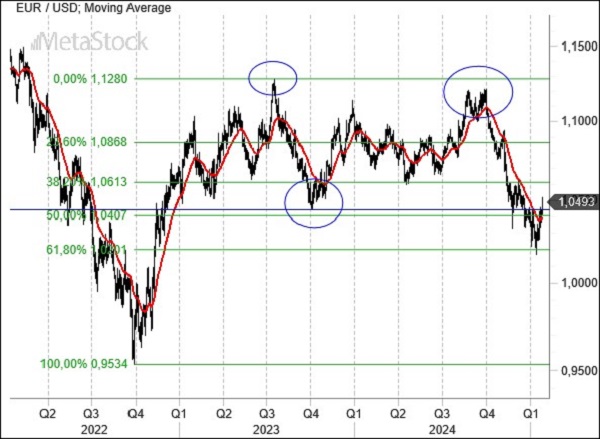

- EUR/USD is responding well to support levels, moving away from the dangerous zone of 1.02. Now, resistance at 1.05 will test the strength of the bulls.

Trump’s Inauguration Fuels Currency Market Shifts and Economic Uncertainty

Trump’s inauguration has provided ample material for the currency market, with many currencies recovering against the dollar, driven by speculation on the relatively mild rhetoric from the tycoon during his inaugural speech on tariffs. However, it only took a few hours before Trump unleashed his wrath on practically all trade partners. The 25% tariffs on Canada and Mexico were well-known, as was his intention to force Europe into buying American gas and oil. But it was directly toward Europe that Trump turned, threatening tariffs unless sufficient measures were taken to reduce the trade deficit. The negotiations will likely now shift to military spending. In the absence of the Federal Reserve and Jerome Powell, the stock market is enjoying positive earnings reports and, more importantly, the launch of the Stargate plan, which would further drive investments in artificial intelligence, fueling more speculation across the tech sector. Meanwhile, bond yields remain above 4.5% on US ten-year notes, signaling that the market doesn’t expect the Fed to cut interest rates in a context of economic growth that risks overheating, directly impacting the inflation that has been so difficult to tame. Powell will have his work cut out trying to contain Trump’s desire to lower the cost of money, but it is clear that under these conditions, it would be like throwing gasoline on the inflation fire. As long as the labor market shows no signs of weakness, it is hard to think of a reversal for the dollar, which has been bolstered by strong inflows and a favorable interest rate differential. Europe, meanwhile, is navigating uncertain waters between expected interest rate cuts and uncertain economic growth, with Germany’s upcoming election in February set to be a key market mover for the first part of 2025.

Technical Analysis: EUR/USD Reacts to Trump’s Tariffs at Key Support

Trump’s attack on Europe, threatening tariffs due to the massive US trade deficit with the EU, combined with Lagarde’s more realistic stance on potential rate cuts, has allowed the euro to regain ground against the dollar. This recovery was no accident, as it occurred precisely at the 1.02 support level, which we had identified as the last line of defense for the single currency. This is the first sign, but it doesn’t change the prevailing trends—short, medium, and long-term. The euro must first reclaim 1.05 (which has already been achieved) and then 1.06 to deliver a blow that would likely mark the definitive bottom for the greenback. Seasonality and the lack of signals from the Fed should still draw money toward the dollar in the coming weeks, as we expect sentiment to become even more overheated.

The United States is living through this golden age in a very peculiar situation, with both the dollar and gold strengthening. An unusual divergence, as the yellow metal continues to rise despite positive real interest rates, in a context of very benign sentiment toward the US dollar. It is possible that the gap will narrow in the coming weeks, with a weaker dollar and gold continuing to move within a sideways range near historic highs.

Leave a Reply

You must be logged in to post a comment.