Category: Currencies

-

EUR/USD Weekly Outlook – January 20, 2025: Parity in Sight as Dollar Strengthens Amid Global Economic Shifts

Trump is officially the new president of the United States, and now the market awaits clarity on the much-discussed protectionist measures. The forex market remains volatile, with the euro struggling to recover after better-than-expected U.S. inflation data. Meanwhile, in Germany, it is now certain that 2024 will be marked by another economic recession.

-

EUR/USD Weekly Outlook, January 6, 2025 – Gas Crisis and Interest Rates Impacting the Euro

The gas war reignites tensions over energy prices in Europe and also puts pressure on the euro, whose performance is hindered by political concerns in key countries like France and Germany, as well as macroeconomic data that continues to offer little reassurance regarding recovery. Meanwhile, expectations grow for Trump’s inauguration at the White House.

-

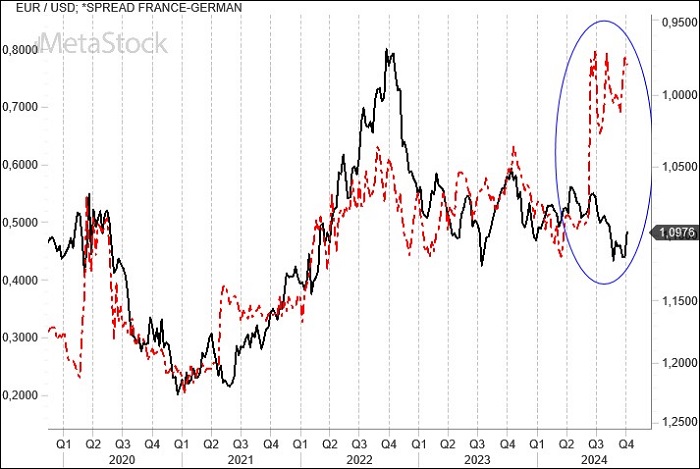

EUR/USD Weekly Outlook for December 9, 2024 – European Crisis Deepens as U.S. Economy Strengthens

The European political and economic crisis is worsening. Following Germany, France may also face new elections after the collapse of the Barnier government, or Macron will need to try to form a new government. This crisis contrasts with a U.S. economy that is thriving, which of course strengthens the U.S. dollar. However, technically, we still…

-

Weekly EurUsd Outlook for November 18, 2024 – Rising Volatility and the Looming Risk of Parity

Trump’s Election Boosts Dollar Amid Eurozone Weakness There is no doubt that Trump’s election has triggered substantial buying volumes for the U.S. dollar while driving sales of the euro and Japanese yen. Markets anticipate increased domestic investment (reflected in gains for small-cap stocks) at the expense of foreign investments, weighing heavily on European markets already…

-

Weekly Outlook for November 4, 2024 – U.S. Election and Fed Decisions in Focus

EurUsd maintains its positions above the key support level of 1.08; however, the two main market movers will undoubtedly define the dynamics of the exchange rate in the coming days with greater precision.

-

Weekly EUR/USD Outlook for October 14, 2024 – Rate Differentials & ECB Policy Set the Stage

Geopolitical tensions that persist globally do not appear to be disrupting financial markets, which are reaching new all-time highs in equities and showing less concern about an economic recession, at least in the United States, despite the resurgence of inflation. This week, the ECB is expected to cut interest rates, while EUR/USD seems to be…

-

Weekly EUR/USD Outlook for October 7, 2024 – Middle Eastern Conflict Bolsters Dollar as Inflation Declines in Europe

Geopolitical Tensions Lift Oil Prices, Strong U.S. Jobs Data Challenges Fed Rate Cuts Markets remain tense amid the wave of Middle Eastern war tensions. Israel’s attack on Lebanon and Iran’s retaliatory response on Israeli soil threaten to expand the conflict. However, markets have found some comfort in China’s decisive actions to combat the stagnation of…

-

Weekly Eur/Usd Outlook for September 30, 2024 – Euro Holds as U.S. Rate Cuts Loom

Global bond yields continue to compress, signaling that markets expect more accommodative policies from central banks. While Europe seems headed for recession, China is reviving its monetary and fiscal tools in an effort to escape an increasingly entrenched deflationary crisis.

-

Weekly EUR/USD Outlook – September 23, 2024 – Fed’s Surprise Rate Cut

Fed’s Aggressive Rate Cuts Spark Debate as Economic Uncertainty Grows In alignment with bond market expectations, the Fed acted swiftly with a substantial 50 basis point rate cut, possibly aiming to make up for lost ground in August. The market now anticipates two additional 25 basis point cuts in the year’s final two meetings, scheduled…

-

Weekly EurUsd Outlook for September 16, 2024 – Central Banks Take the Stage Amid Key Resistance Levels

The dollar holds steady, and the euro fails to advance. This sums up a week in which the ECB fulfilled its promise to cut interest rates, while U.S. inflation, at 2.5%, set the stage for a similar move by the Fed in what will be the final meeting before the much-anticipated presidential elections in November.