Category: Economic Indicators

-

EurUsd Weekly Outlook for June 12, 2023 – Attention Shifts to Interest Rates Decisions

The United States, as is often the case, managed to dodge the default bullet at the last minute. The spotlight now swings to the Federal Reserve (Fed) and the European Central Bank (ECB), whose impending monetary policy decisions are set to shape the trajectory of the stock and bond markets over the summer. These markets…

-

Japan’s Economy Surpasses Growth Expectations

Japan’s economy experienced stronger growth in the first quarter of the year than previously estimated, according to government data released on Thursday. The annualized growth rate reached 2.7%, surpassing the earlier projection of 1.6% made last month. The Japanese yen saw a modest 0.14% strengthening against the U.S. dollar following the announcement, while the Nikkei…

-

Senate Passes Bipartisan Bill to Raise Debt Ceiling and Avert U.S. Default

The Senate passed a bill on Thursday evening, which had previously been approved by the House, to raise the debt ceiling and establish a cap on government spending for a two-year period. The legislation is now on its way to President Joe Biden, and he is expected to sign it on Friday. In his statement…

-

German Economy Slides into Recession Amidst Reduced Consumer Spending

The German economy slid into a technical recession in the first quarter of this year, triggered by a significant decrease in consumer spending. Data from Germany’s Statistics Office, released on Thursday, indicated a 0.3% contraction in GDP (gross domestic product) for the year’s opening quarter, a downturn from the initially reported zero growth. This development…

-

ECB Raises Interest Rates to Tackle High Inflation Pressures

The European Central Bank (ECB) has announced a 25 basis point increase in three key interest rates to tackle high inflation pressures. Despite headline inflation declining over recent months, underlying price pressures remain strong, prompting the decision to raise interest rates. The ECB’s Governing Council has pledged to continue using a data-dependent approach to determine…

-

Inflation in Euro Zone Surges While Core Price Growth Experiences Unanticipated Decline

Recently released preliminary data reveals a surge in the euro zone’s headline inflation rate in April, while core price growth took an unexpected downturn. Eurostat reports that last month’s headline inflation reached 7%, a slight increase from 6.9% in March. However, core inflation, which factors out food and energy prices, dipped to 5.6% in April,…

-

RBA Defies Expectations: Surprise Interest Rate Hike Aims to Tame Stubborn Inflation

In a statement released on 2 May 2023, Philip Lowe, Governor of the Reserve Bank of Australia (RBA), announced that the Board has decided to increase the cash rate target by 25 basis points to 3.85%. The rate paid on Exchange Settlement balances has also been increased by 25 basis points to 3.75%. This decision…

-

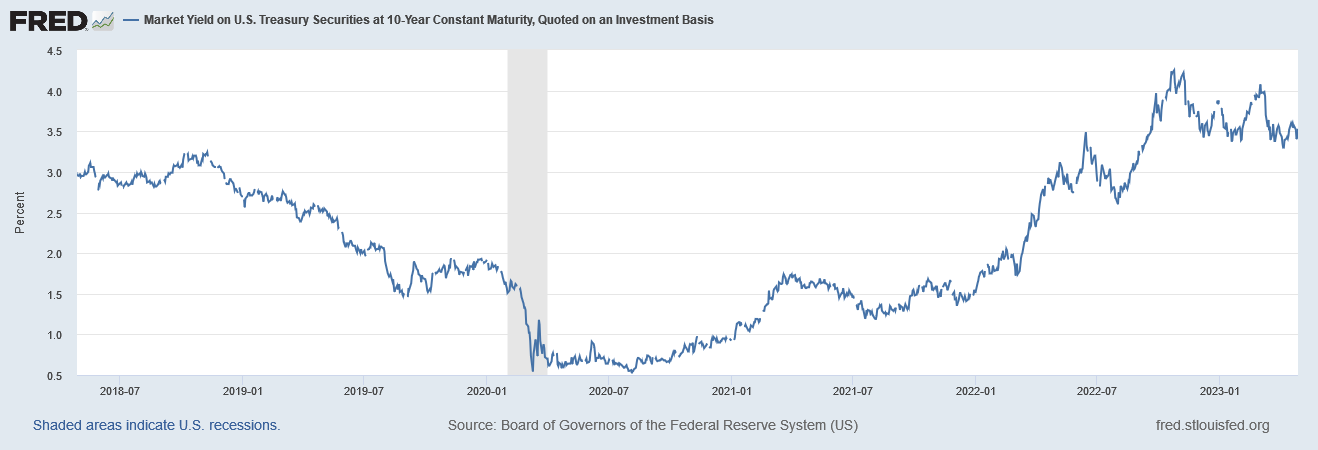

10-Year Treasury Yield Unveiled: Key Insights and Market Implications

The Market Yield on U.S. Treasury Securities at 10-Year Constant Maturity is a key financial indicator, serving as a benchmark for long-term interest rates and offering valuable insights into the health of the economy and credit markets. This measure reflects the yield on a hypothetical U.S. Treasury security with a fixed maturity of 10 years,…

-

Anticipation Builds for Federal Reserve and ECB Interest Rate Decisions Amid Key Economic Indicators

Central banks worldwide are in the spotlight this week, as investors eagerly anticipate policy-setting meetings from the Federal Reserve and the European Central Bank (ECB). Market participants will also be closely watching the monthly U.S. jobs report and other key economic indicators for insights into the health of the global economy.The Federal Open Market Committee’s…