Category: Forex

-

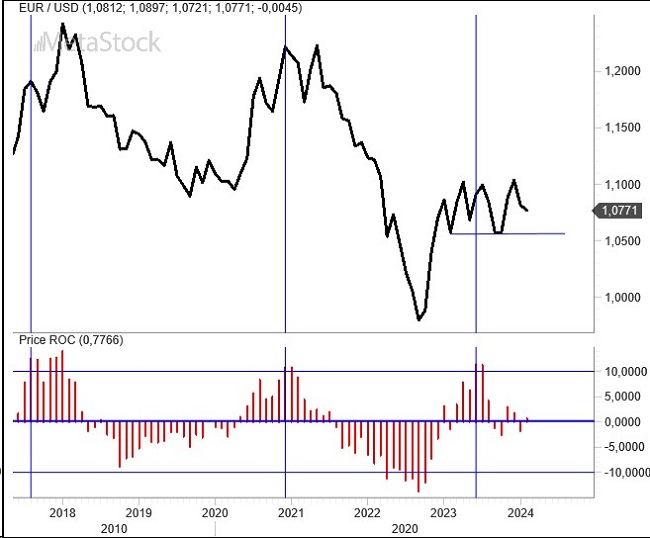

EurUsd Weekly Outlook for February 26, 2024 – Navigating Through Low Growth, Rate Expectations, and Seasonal Trends

Few news are coming from the United States where the market is becoming more realistic about the evolution of monetary policy. Amid alternating statements from various central bankers, the market has acknowledged that there will be no reductions in the cost of money before summer. Meanwhile, in Europe, all growth estimates have been revised downwards,…

-

EurUsd Weekly Outlook for February 19, 2024 – Is the Trend Reversal Upon Us?

To see inflation with a 2 in front of it in America, we will have to wait a bit longer. The annual change in American consumer prices has negatively surprised analysts, even in the core figure stripped of volatile components. A rate cut in the United States becomes more distant, while it’s a current topic…

-

Weekly EurUsd Outlook for February 12, 2024 – Powell’s Caution and Europe’s Struggles Shape Markets

A Mixed Markets Outlook In a media interview, Powell took a cautious stance. We are convinced that the path back to 2% is underway, declared the Federal Reserve Chairman, but it’s better to be prudent given the recent and very positive results from the job market. Translating this into practical terms, even the rate cut…

-

EurUsd Weekly Outlook for February 5, 2024 – Fed Holds Rates Steady, Eyes on ECB for Spring Cut

The Fed holds firm on rates, promising markets that a cut will come but only when inflation has provided concrete signs of definitively converging towards 2%. In Europe, zero growth in the fourth quarter was confirmed, anticipating a rate cut in spring. EurUsd continues to press on the 1.08 supports.

-

EurUsd Weekly Outlook for January 29, 2024 – A Period of Calm Amidst ECB Steadiness & Market Anticipation

Trump continues his ride in the Republican primaries, which should lead him to be the candidate in the challenge against Biden. Markets remain calm in a data-scarce week with the ECB as the sole protagonist, yet offering few leads for investors. EurUsd reaches significant support levels, beyond which windows favorable to the American dollar would…

-

EurUsd Weekly Outlook for January 22, 2024 – Contrasting Economic Signals as Presidential Race Heats Up

As the race for the U.S. Presidential election in November 2024 begins with Trump’s return, polls show him gaining popularity, but the real economy is showing mixed signals. In Europe, inflation expectations are falling, while in America, consumer prices have stopped declining. Meanwhile, EurUsd remains trapped in a range that has brought the exchange rate…

-

EurUsd Weekly Outlook for January 15, 2024 – Balancing Key Supports and Resistances in a Mixed Economic Landscape

2024 starts with Market Uncertainty Amidst Inflation and Economic Divergence The year 2024 kicked off under a cloud of uncertainty for stock and currency markets. Excessive optimism about a quick inflation retreat (and hence a Fed rate cut) was dampened by recent U.S. labor market data, followed by the eagerly awaited December inflation figures. The…

-

EurUsd Weekly Outlook for January 8, 2024 – Navigating Uncertainty in a Volatile Market Landscape

The initial 2024 macroeconomic indicators confirm a slowdown in growth even in the United States, although a recession seems distant given the robust performance of the job market. With the presidential elections set for 2024, the Federal Reserve, if it wishes to act, will need to do so primarily in the first half of the…

-

EurUsd Weekly Outlook for December 18, 2023 – Anticipating Rate Cuts and Navigating Market Shifts

The Fed breaks its hesitation, giving the markets what they expected: confirmation that interest rates will fall in 2024. The ECB seems more hesitant in a rate hike cycle that, however, appears to have concluded with the successful battle against inflation. Stock markets soar, bond yields fall, and the U.S. dollar weakens.

-

EurUsd Weekly Outlook for December 11, 2023 – Central Banks’ Decisions Set to Shape Currency Dynamics Ahead of the Holidays

An interim week as we await the final central bank meetings before the year-end closure. Incoming data from the USA confirms that a recession is not on the horizon, while in Europe, a rate cut seems more likely given the state of the economy and inflation. Meanwhile, EurUsd moves away from resistances.