Category: General

-

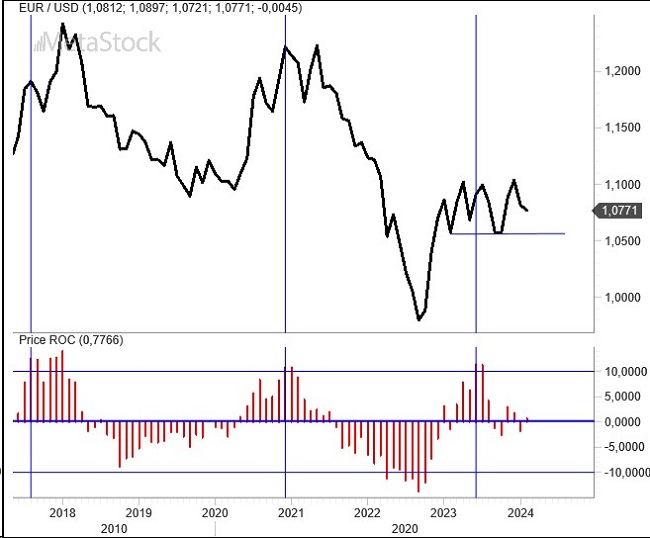

Weekly Outlook for EurUsd as of May 6, 2024 – Dollar’s Defense Tested Amidst Economic Uncertainty

As predicted, the Fed keeps rates unchanged at 5.5%, while simultaneously slowing down the pace of reducing the central bank’s balance sheet. The economy continues to run at full throttle, coupled with low unemployment, which prevents inflation from decreasing as expected, forcing the Fed to maintain a restrictive monetary policy. The dollar remains strong but…

-

EurUsd Weekly Outlook, April 22, 2024 – Diverging Monetary Paths and the Test at 1.05

The monetary policies of the Federal Reserve and the European Central Bank are heading in opposite directions. Jerome Powell has adopted a more hawkish stance than Christine Lagarde, pushing up U.S. interest rates and bolstering the dollar, which is further favored by an increasingly tense geopolitical climate. The widening gap between the growth and expected…

-

EurUsd Weekly Outlook for March 4, 2024 – Navigating the Tides of Central Bank Rhetoric and Market Optimism

Fed Rate Cuts, Robust Growth, and Political Dynamics Once upon a time, there were anticipated rate cuts promised by the Fed. With each passing week, expectations for a reduction in the cost of money have shrunk, and as of today, the market anticipates a cut of 75 basis points by the end of 2024, down…

-

EurUsd Weekly Outlook for February 19, 2024 – Is the Trend Reversal Upon Us?

To see inflation with a 2 in front of it in America, we will have to wait a bit longer. The annual change in American consumer prices has negatively surprised analysts, even in the core figure stripped of volatile components. A rate cut in the United States becomes more distant, while it’s a current topic…

-

Weekly EurUsd Outlook for February 12, 2024 – Powell’s Caution and Europe’s Struggles Shape Markets

A Mixed Markets Outlook In a media interview, Powell took a cautious stance. We are convinced that the path back to 2% is underway, declared the Federal Reserve Chairman, but it’s better to be prudent given the recent and very positive results from the job market. Translating this into practical terms, even the rate cut…

-

EurUsd Weekly Outlook for February 5, 2024 – Fed Holds Rates Steady, Eyes on ECB for Spring Cut

The Fed holds firm on rates, promising markets that a cut will come but only when inflation has provided concrete signs of definitively converging towards 2%. In Europe, zero growth in the fourth quarter was confirmed, anticipating a rate cut in spring. EurUsd continues to press on the 1.08 supports.

-

EurUsd Weekly Outlook for January 8, 2024 – Navigating Uncertainty in a Volatile Market Landscape

The initial 2024 macroeconomic indicators confirm a slowdown in growth even in the United States, although a recession seems distant given the robust performance of the job market. With the presidential elections set for 2024, the Federal Reserve, if it wishes to act, will need to do so primarily in the first half of the…

-

EurUsd Weekly Outlook for December 18, 2023 – Anticipating Rate Cuts and Navigating Market Shifts

The Fed breaks its hesitation, giving the markets what they expected: confirmation that interest rates will fall in 2024. The ECB seems more hesitant in a rate hike cycle that, however, appears to have concluded with the successful battle against inflation. Stock markets soar, bond yields fall, and the U.S. dollar weakens.

-

EurUsd Weekly Outlook for December 4, 2023 – Positive Shifts in American GDP and Seasonal Advantages Set the Stage

Last week brought few macroeconomic updates. Employment and inflation will be the focus in the coming days, along with the highly anticipated central bank meetings. The positive revision of the American GDP for the third quarter is surprising, and meanwhile, for EurUsd, the seasonally most favorable month of the year begins.

-

Weekly EurUsd Outlook for November 28, 2023 – Navigating Political Shifts and Key Resistance Levels

Few macroeconomic events marked a short week due to the American Thanksgiving holiday. The inevitable statements from some central bankers and the Dutch political elections provided some points of interest. Meanwhile, EurUsd continues to move away from critical levels and is now facing resistance in the 1.10 area.