Category: Global

-

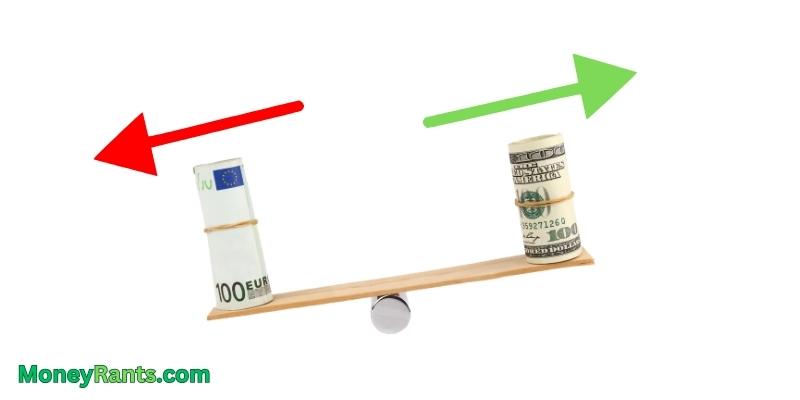

EurUsd Weekly Outlook for October 2, 2023 – Navigating Central Banks & a Potential Shutdown

In the U.S., the specter of a shutdown re-emerges amidst central banks’ staunch determination to curb inflationary pressures. The bond market takes a sharp downturn, equity markets retreat, while the dollar stands strong, asserting its position as the primary safe haven. Over in Europe, the euro’s faltering strength might present challenges for the ECB in…

-

EurUsd Weekly Outlook for September 26, 2023 – The Fed prefers High Rates, Rate Cuts Might Return only at the end of 2024

In the United States, monetary policy will remain restrictive for a prolonged period, and the Fed foresees rate cuts only towards the end of 2024. This is good news for the dollar but bad news for bonds and the euro. Upcoming data will provide a clearer direction for a central bank that appeared more aggressive…

-

EurUsd Weekly Outlook for September 18, 2023 – Inflation Remains Resilient

In the United States, we may have already seen the inflation low point for 2023, as the last two months have shown an uptick that could presage another round of increases driven by rising energy costs and wage pressures. Meanwhile, the European Central Bank raises interest rates but adopts a dovish tone that weakens the…

-

Weekly EurUsd Outlook: U.S.-Europe Growth Gaps Weigh Heavy; A Closer Look at Interest Rates

After weeks of market speculation, it seems the consensus is settling in: interest rates are poised to remain elevated, perhaps even higher than current levels, for an extended period. Remarkably resilient to the Federal Reserve’s shock treatment on the cost of capital, the U.S. economy shows no signs of wavering. Europe’s economy, on the other…

-

EurUsd Weekly Outlook for September 4, 2023 – A Shifting Landscape

Inflation doesn’t seem to be easily yielding ground in Europe, while in America, there are some yet timid signs of economic slowdown. The Fed is holding steady on interest rates into September, and increased uncertainty in Europe is not boosting EurUsd. It is instead attempting to break a significant dynamic support level, which would put…

-

EurUsd Weekly Outlook for August 28, 2023 – A Gray Cloud from Jackson Hole

Inflation remains too high, requiring the maintenance of elevated interest rates for an extended period. Powell and Lagarde reiterated the views of the world’s two most important central banks at the Jackson Hole symposium. Both the Fed and the ECB may consider a pause for reflection in September, a move that markets have appreciated. However,…

-

EurUsd Weekly Outlook for August 14 2023 – Rates cannot decrease with these macro data

The American inflation rises in July as forecasted, after a year of steady decline. Producer prices are also seeing an uptick. Economic forecasts of accelerated growth prompt the FED to be cautious about easing their grip on interest rates. The EurUsd remains in a limbo phase, awaiting the Jackson Hole meeting at the end of…

-

EurUsd Weekly Outlook for August 7, 2023 – Farewell to Triple A, Credit Downgrade that Could Spell Good News for the Dollar

The US debt loses its Triple A rating, a somewhat surprising decision by the Fitch Ratings agency, which has increased market volatility in the context of an ongoing restrictive monetary policy. Meanwhile in Europe, the submissive producer prices are raising doubts in Frankfurt about the prudence of further interest rate hikes. Amidst volatility, the EurUsd…

-

Japan’s Economy Surpasses Growth Expectations

Japan’s economy experienced stronger growth in the first quarter of the year than previously estimated, according to government data released on Thursday. The annualized growth rate reached 2.7%, surpassing the earlier projection of 1.6% made last month. The Japanese yen saw a modest 0.14% strengthening against the U.S. dollar following the announcement, while the Nikkei…

-

ECB Raises Interest Rates to Tackle High Inflation Pressures

The European Central Bank (ECB) has announced a 25 basis point increase in three key interest rates to tackle high inflation pressures. Despite headline inflation declining over recent months, underlying price pressures remain strong, prompting the decision to raise interest rates. The ECB’s Governing Council has pledged to continue using a data-dependent approach to determine…